Business Insolvency Company Experts: Aiding You Conquer Financial Challenges

Business Insolvency Company Experts: Aiding You Conquer Financial Challenges

Blog Article

Look Into the Intricacies of Bankruptcy Providers and Just How They Can Offer the Assistance You Need

Browsing the intricacies of bankruptcy can be a complicated task for individuals and services alike. When economic obstacles loom huge, seeking the aid of insolvency solutions becomes vital in locating a way forward. These solutions offer a lifeline for those dealing with overwhelming debt or financial distress, supplying a series of options customized to each distinct circumstance. Recognizing the ins and outs of bankruptcy services and just how they can provide the necessary support is vital to making informed decisions throughout tough times. In discovering the various elements of insolvency solutions and the benefits they bring, a clearer path to financial stability and recuperation arises.

Recognizing Bankruptcy Services

One key facet of recognizing bankruptcy services is acknowledging the various insolvency procedures offered under the law. For people, choices such as individual voluntary plans (IVAs) or personal bankruptcy may be thought about, while businesses may discover company voluntary arrangements (CVAs) or management. Each option comes with its own collection of requirements, ramifications, and prospective results, making it vital to look for professional guidance to make enlightened decisions.

Furthermore, bankruptcy specialists can give important suggestions on taking care of creditors, bargaining settlements, and restructuring debts to attain monetary security. By recognizing insolvency solutions and the support they offer, businesses and people can browse tough financial conditions with self-confidence and clarity.

Kinds Of Insolvency Solutions

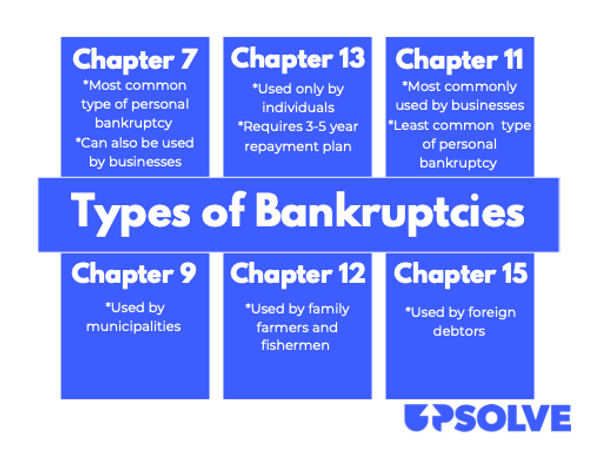

What are the unique sorts of insolvency services readily available to individuals and services in economic distress? When confronted with bankruptcy, there are numerous paths that people and organizations can require to resolve their monetary difficulties. One usual insolvency option is bankruptcy, which entails a legal process where an individual or business declares that they are unable to settle their financial obligations. Business Insolvency Company. Via insolvency, possessions might be sold off to repay financial institutions, supplying a clean slate for the specific or company.

Another insolvency remedy is an Individual Volunteer Setup (INDIVIDUAL VOLUNTARY AGREEMENT), an official arrangement between a private and their creditors to repay financial obligations over a details duration. Individual voluntary agreements supply an organized means to handle financial obligation while avoiding bankruptcy.

For businesses, administration is a type of insolvency remedy that entails assigning an administrator to manage the business's affairs and job in the direction of a recovery or organized ending up of business. This can aid services in economic distress restructure and possibly stay clear of closure. Each of these bankruptcy services supplies a various method to solving economic difficulties, accommodating the unique demands of individuals and organizations facing bankruptcy.

Benefits of Seeking Specialist Assistance

When browsing bankruptcy can supply people and companies with specialist support and critical remedies to efficiently manage their monetary difficulties,Seeking expert help. Bankruptcy specialists bring a riches of experience and expertise to the table, using customized suggestions based on the particular scenarios of each case. By enlisting the solutions of bankruptcy professionals, clients can benefit from an organized approach to resolving their financial troubles, making sure that all offered alternatives are explored and the most feasible service is sought.

Moreover, expert insolvency specialists have a deep understanding of the regulatory and legal structures bordering bankruptcy process. This know-how can be important in ensuring conformity with pertinent legislations and regulations, decreasing the threat of pricey mistakes or oversights throughout the bankruptcy process.

Furthermore, engaging expert aid can aid relieve the stress and anxiety and worry linked with bankruptcy, enabling individuals and find here businesses to concentrate on rebuilding their financial health and wellness (Business Insolvency Company). The support and advice supplied by bankruptcy experts can infuse self-confidence and quality in decision-making, equipping customers to navigate the intricacies of insolvency with higher simplicity and performance

Importance of Timely Intervention

Having recognized the benefits of specialist support in managing economic challenges during bankruptcy, it comes to be imperative to underscore the crucial significance of prompt treatment in such conditions. Timely treatment plays a critical function in reducing further financial damage and maximizing the possibilities of effective restructuring or recuperation. When encountering insolvency, delays in looking for assistance can intensify the situation, resulting in increased financial debts, legal complications, and potential liquidation. By acting quickly and involving insolvency services at the earliest signs of financial distress, people and businesses can access tailored options to resolve their details demands and browse the intricacies of bankruptcy process more properly.

Trigger intervention enables a comprehensive assessment of the economic scenario, enabling experts to establish strategic strategies and launch required activities quickly. This positive technique not just safeguards assets however additionally boosts the potential customers of attaining a favorable outcome. Additionally, prompt intervention shows a commitment to dealing with monetary difficulties responsibly and morally, instilling confidence in stakeholders and fostering count on the bankruptcy procedure. Finally, the relevance of timely treatment in bankruptcy can not be overstated, as it functions as a crucial element in figuring out the success of financial recovery efforts.

Navigating Insolvency Procedures

Effective navigation via bankruptcy procedures is necessary for individuals and services encountering economic distress. Business Insolvency Company. When have a peek at these guys managing insolvency, understanding the numerous treatments and needs is critical to guarantee conformity and maximize the opportunities of an effective resolution. The primary step in navigating insolvency procedures is normally assessing the monetary circumstance and figuring out one of the most appropriate strategy. This may involve taking into consideration options such as informal arrangements with creditors, becoming part of a formal insolvency procedure like management or liquidation, or discovering alternate services like Company Voluntary Setups (CVAs)

Engaging with insolvency professionals, such as certified insolvency professionals, can offer useful assistance throughout the procedure. These experts have the know-how to assist navigate complicated legal needs, connect with financial institutions, and establish restructuring strategies to deal with economic difficulties successfully. Additionally, looking for early recommendations and intervention can aid reduce threats and enhance the likelihood of an effective end result. By comprehending and effectively browsing insolvency treatments, organizations and people can function towards settling their monetary obstacles and attaining a fresh start.

Verdict

By seeking professional aid, services and individuals can navigate insolvency procedures efficiently and discover numerous services to resolve their financial difficulties. Comprehending the ins and outs of insolvency services can assist individuals make informed choices and take control of their financial well-being.

One secret element of recognizing bankruptcy solutions is identifying the different bankruptcy procedures offered under the law. Each of these bankruptcy solutions uses a different approach to resolving economic troubles, catering to the unique requirements of organizations and people dealing with insolvency.

Engaging with bankruptcy specialists, such as accredited bankruptcy practitioners, can supply beneficial guidance throughout the process.

Report this page